Should Canada hike taxes on investment income? Not so fast.

Yes, most investment income flows to the wealthy. But we need a tax environment that encourages new firms to start, grow, and prosper.

Share

Tax experts never seem to stop debating the appropriate taxation of income from investments, whether from capital gains or dividends. Back in the 1960s when the Carter commission was setting down principles they hoped would guide the design of our tax system, the mantra of “a buck is a buck” was a central consideration. Here’s the idea: a dollar of income buys you the same shopping cart of food whether that dollar came from the paycheque from your job or if it came from selling a stock you own. The Carter framework still motivates much tax analysis in Canada, nearly 50 years later.

Implementing “a buck is a buck” was easier said than done. For investment income, the bucks you get back from your investment may already have been taxed at the corporate level before you got them. If you apply corporate tax and then full personal tax on top of that, you’re going to end up taxing that capital income much more heavily than the tax on regular income from your job. That’s why the Carter commission emphasized the need to account for the corporate taxes already paid when we tax investment income on the personal tax form. We do that by taxing capital gains and dividends at lower rates than we do ordinary income from your job. After some calculations to determine those preferred rates on investment income, tax policy-makers can get the total taxes paid on corporate payouts to be roughly equal to what you pay in tax from your regular job.

This preferential treatment of capital gains and dividend income is a frequent target for analysts concerned about inequality. Both the Broadbent Institute and the Canadian Centre for Policy Alternatives have called for taxing investment income at full personal rates. They’re concerned about investment income because it is very concentrated among high earners.

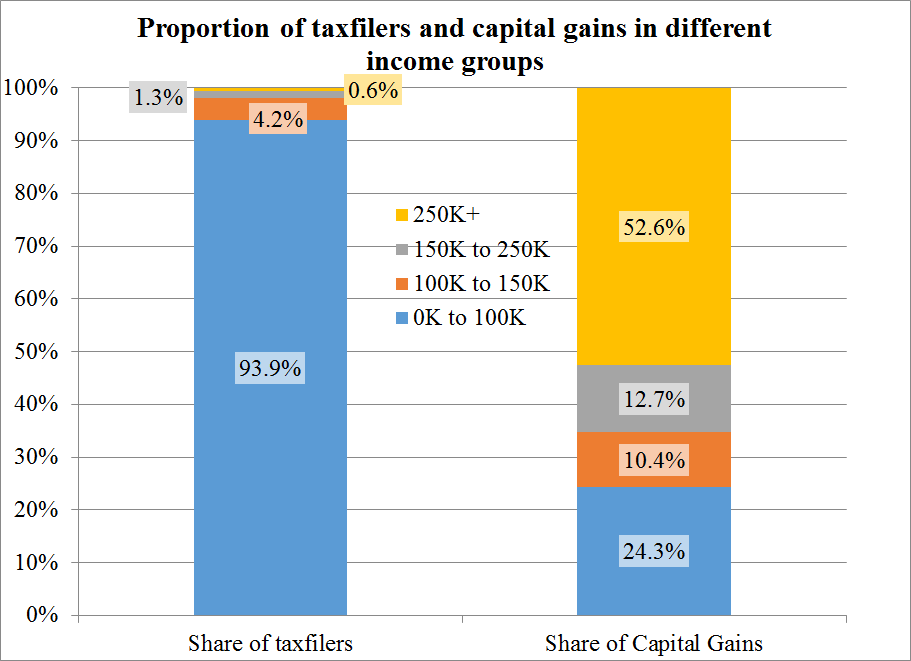

You can see that featured in the “who gets what” chart below. On the left-hand side I show the proportion of individual taxfilers in each income group using 2011 data from the CRA. On the right-hand side I show the share of realized taxable capital gains income going to each of the income groups. Those with $250,000 or more of total income account for only 0.6 per cent of the taxfiling population, but receive 52.6 per cent of taxable capital gains income. Those with income under $100,000 total 94 per cent of the population, but report only 24 per cent of taxable capital gains.

I argued last week in my Econowatch post on the new family tax package that the “who gets what” chart should not be the only part of tax analysis—there may be other goals to consider as well. In this case of investment income, there is another important consideration—efficiency in the decision to invest. Investment through corporations builds capacity for the economy, which means more work, better wages, and more opportunity for the future.

A great debate has raged for at least 35 years among economists: does taxation of investment income affect how much firms actually invest? A key determinant is whether the provider of the investment funds to the firm is someone who faces Canadian taxes. Economists Robin Boadway and Jean-François Tremblay recently argued that we can have full taxation of dividends and capital gains without hurting corporate investment. They reason that in an internationally open economy like Canada, firms can source their investment dollars from foreign investors who don’t pay Canadian tax. On the other hand, economists like Jack Mintz have long argued that Canadian taxes do matter for investment, and consequently full taxation of investment income will harm Canadian companies.

Who’s right? In my view, everyone’s a little right. That’s possible because not all firms are the same. Some companies are small startups. They’re not going to float shares on the stock exchange yet; they’re going to fund things with dollars they or others provide as equity to the company, or from bank loans. Those early investors are going to care about capital gains if the firm goes public with an IPO one day and about dividend taxes if the firm starts paying dividends. Other companies a bit more mature might fund further expansion by floating new shares to Canadian investors. Again in this case, investment income taxes will matter. Finally, there are big blue-chip companies that might trade on big stock exchanges and finance themselves by issuing bonds. For them, it is more likely that Canadian taxes won’t matter because they can access foreign capital much more easily. Recent evidence from the U.S., Sweden, and Europe lines up very well with this idea that investment income taxation matters most for smaller, newer, growing firms.

It’s important to carve out a competitive tax environment for new and growing firms. In British Columbia, employment in the tech sector exceeds employment in mining, oil, and logging combined. We’ve heard lots about how trade and technical change are turning many industries upside-down and hollowing out the job market for middle-earners. I think those concerns about the middle class are real, and the best way for us to combat those big trends is not to try to recreate the economy of 1980. Instead, we should make sure we have plentiful new firms actively competing and growing to provide the jobs of tomorrow. Having the right tax regime for investment is a crucial part of that innovative investment environment that we want.

The tax system isn’t everything, of course. There may be someone beavering away right now in a basement in Burnaby, B.C.; working on an idea that will someday launch a world-beating Canadian company. I bet if you asked her, she might care a lot more about producing a cool product that people will want to use than guessing what the capital gains tax rate will be in 2023.

But, taxes still matter, even in her case. At some point she will need to attract some capital to get her idea out of that Burnaby basement and launch her product. She will need to get some of her friends to quit their existing, safe, well-paying jobs to take a leap of faith to work with her. She might not care about tax rates herself, but those potential investors and key human talent have other options available to them and she’ll need to offer competitive finances to get them to come her way. Taxes are a part of that.

The “who gets what” analysis behind the calls from the Broadbent Institute and the CCPA to fully tax investment income is interesting, but doesn’t provide the whole picture. We also need to consider how to build the economy of the future—and one part of that is a tax environment that encourages new firms to start, grow, and prosper.

(I’m going to be talking about the future of the Canadian income tax system on Tuesday, Nov. 25 in Toronto. Find more details here.)