The seniors’ budget

Kevin Milligan reviews the federal budget perks targeted at seniors—a group already in relatively good financial shape

Share

I was not in the budget lock-up, so am offering this up after just a few minutes of reflection.

My Maclean’s colleagues have put together this comprehensive analysis, so let me focus on just one thing: seniors.

I agree with the Globe and Mail‘s Rob Carrick, who argued that today’s budget is focused largely on seniors. Several items in this Top 9 budget list from John Geddes pertain directly to seniors: changes to the RRIF withdrawal rules, for example, and the TFSA expansions that allow seniors to shelter more of their RRIF withdrawals from further taxation.

Related reading: Seniors and the generation spending gap

Everyone loves Grandmother, so one must always tread lightly when discussing the economic plight of seniors. However, when you look at the data, it’s hard to ignore that today’s seniors seem to have a lot of economic tools to face challenges. From sky-high housing equity to several tax-free savings opportunities to extra credits just for being old, seniors are in relatively good shape, on the whole. As a policy focus, I would like to see some better justification for continuing to enhance the economic tools of our seniors while other priorities languish.

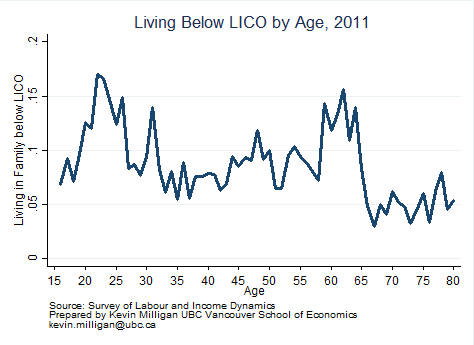

In the chart, I’ve graphed the proportion of Canadians in 2011 who live in families with income below the low-income cut-off. The age pattern strongly suggests that those older than 65 show the smallest proportion under the line. This development is a well-known policy success in Canada, but again emphasizes the question of when we ought to turn our attention to making sure other groups of Canadians also obtain the economic tools to face the challenges they encounter.