financial planning

High demand for financial planners ensures long-term job security

FOR YEARS NOW, businesses and policymakers have warned of the so-called skills shortage in Canada. Most Canadians have heard about the urgent need for more employees with science and technology training and, thanks in large part to the pandemic, for workers in the hospitality, construction and manufacturing sectors. Yet there is another occupation that is in very high demand, though it might not get as much attention: financial planning. In fact, the job prospects for those who choose this career are excellent.

Financial planning as a career

FRED ZHOU’S CAREER as a financial planner has roots in his childhood. Growing up in Kamloops, B.C., Zhou would often serve as a translator for his mother, who did not speak much English. When he was eight, he and his mom met with a financial advisor who encouraged her to open a registered education savings plan for Fred and his brother. “If my mom had not met that person, she most likely wouldn’t have invested in an RESP,” Zhou says, “and that might have meant a completely different future for us.”

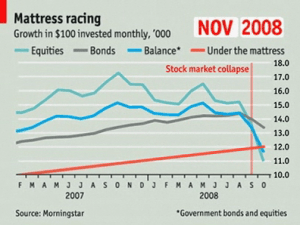

How to stop doing dumb things with your money

No-frills advice for investors from a very frank financial planner

Never mind the facts of life, talk to your children about money

A substantial portion of Canadians have not put very much thought into their financial future

Advice from the rich

Lessons in the way millionaires make (and sometimes lose) their money

A hot new investment tip

BY JASON KIRBY