When banks are too big to behave

Another scandal, another promise to regulate—can banks ever really be trusted?

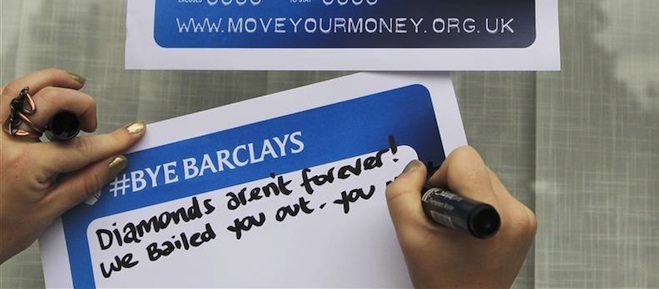

Protestors from the Move Your Money group stick up posters on a branch of Barclays Bank in Westminster central London, July 4, 2012. Barclays chief executive Bob Diamond, who quit this week over an interest rate-rigging scandal, will be questioned by British politicians on Wednesday, when he could drag the Bank of England, the government and rival banks deeper into the Libor interest rate affair. REUTERS/Olivia Harris (BRITAIN – Tags: BUSINESS POLITICS SOCIETY)

Share

As long as there have been banks, there have been banking scandals. The treasurers of Athena burned the Acropolis in an attempted cover-up after secretly lending money to speculative bankers. Wall Street’s first banking scandal—a familiar tale of banks lending too heavily to property speculators who lost it all when the real estate bubble burst—happened in 1837. Banking that breaks the rules “in consequence of some flattering speculation of extraordinary gain, is almost always extremely dangerous and frequently fatal to the banking company which attempts it,” economist Adam Smith warned in The Wealth of Nations nearly 250 years ago.

With that history, it’s understandable that economists don’t quite believe promises by U.K. regulators that the latest scandal to rock the global financial industry—revelations that banks were manipulating a key interest rate affecting more than $300 trillion in worldwide investments—will usher in a new era of ethical banking. “It’s guaranteed to be a losing battle,” says Richard Grossman, an economist at Wesleyan University and author of Unsettled Account: The Evolution of Banking in the Industrialized World since 1800. “The incentives in banking are so strong and the money is so big. As soon as you close off one area, someone is going to think of a new way to do things.”

Related:

The recent LIBOR scandal centers on allegations that several banks falsely reported the rates they expected to pay to borrow money from other banks. (LIBOR stands for the London interbank offer rate.) It has provoked all the usual fallout from a major banking crisis: Barclays, the first bank to settle with U.S. and U.K. regulators, has paid roughly $460 million in fines. CEO Robert Diamond resigned, as did the bank’s Canadian COO, Jerry Del Missier, and its chairman, Marcus Agius. Diamond was hauled before a British parliamentary hearing where politicians read out incriminating emails involving traders congratulating themselves on their misdeeds with offers of expensive champagne, and accused Diamond, with his estimated $145 million in compensation, of personifying a culture of greed and running a “rotten, thieving bank.”

European Central Bank (ECB) president Mario Draghi blamed the scandal on a governance failure, suggesting such a major gaffe wouldn’t have happened on his watch. “I don’t know what the ECB would have done but I hope we would have done better,” he told a German press conference. U.K. regulators have begun rushing to close the loopholes that allowed banks to self-report their own cost of borrowing for years by introducing rules that would make it illegal for them to deliberately misstate their interest rates.

It’s a story we’ve heard before. After all, the 2008 financial crisis ushered in Dodd-Frank in the U.S. and Basel III in Europe. The laws, which meant to crack down on the riskiest activities in global finance by forcing banks to hold more capital and make their derivatives trading more transparent, were deemed the most sweeping regulatory changes since the Great Depression. Many observers at the time figured banking scandals would be behind us once and for all.

Hardly. There have been other supposed watershed moments since then, including the recent scandal involving JPMorgan Chase & Co., whose executives were grilled by a U.S. Senate committee over admissions the bank had lost at least $2 billion trading in risky credit derivatives. A resignation letter by former Goldman Sachs executive director Greg Smith, published in the New York Times in March, in which he complained of bankers referring to their clients as “Muppets,” was also touted as a wake-up call for an industry that seemed oblivious to the fact it had lost all credibility in the eyes of the public.

Finger pointing and piecemeal changes to the rules of banking aren’t nearly enough, says Ilana Singer, deputy director of investor- rights organization FAIR Canada. What’s needed is a change in the culture of banking through regulations that would make it illegal for financial institutions to profit off the misfortunes of their clients. “Banks and other financial firms are often looking out for their own interests and not for the interest of the client,” Singer says. “If there’s a view that regulations are not being enforced in a tough way, they won’t encourage a culture where there is fear of the regulations. It’s a culture of complacency.”

But more regulation and criminal sanctions aren’t likely to stop future financial crises or prompt bankers to suddenly adopt a new ethical code of conduct, says Tom Kirchmaier, a fellow at the London School of Economics’ Financial Markets Group. “We have to get away from this belief that everything needs to be regulated because if we believe that banks are not to be trusted, we need to nationalize them,” he says. “You can’t put a policeman behind every banker.”

Regulation has its limitations, says Grossman. For one, governments and the public have short memories when it comes to financial crises. Regulations that seemed prudent in one era become the next generation’s “political red tape.” There were virtually no financial crises in the Western world from the 1930s to the 1970s. Not because bankers were somehow more ethical, Grossman says, but because restrictive regulations following the Great Depression made it difficult to profit handsomely from risky ventures. Then the economic downturn from the oil price shocks of the 1970s pushed governments to liberalize markets to help kick-start the economy by freeing up global capital.

Another school of thought gaining in popularity is that investment banking should take a page from the innovations in the manufacturing sector by getting rid of the legions of traders and salesmen who unlock hidden profits by dreaming up obscure new securities, and replacing them with more standardized financial products that are traded through electronic clearinghouses. In other words, fewer creative bankers, more reliable computers.

“Standardization of products and process automation will have to replace the tailor-made approach of many trading desks. IT investments in the range of billions [of dollars] will be necessary. The number of people on the trading floors will have to drop to levels currently seen at exchanges,” writes Hugo Banziger, the former chief risk officer at Deutsche Bank who also sits on the international Financial Stability Board, in a position paper published this summer. “Only by actively designing and implementing a new business model that delivers sustainable risk rewards in a transparent fashion, the financial industry will be able to regain acceptance.” His view may signal a shift in the industry, particularly since Banziger is rumoured to be on the list of potential successors to Diamond at Barclays.

Rather than adding more regulations, Kirchmaier says we need a wholesale shift away from a system built on trading in huge volumes of opaque financial products and a return to a simpler era when the duties of the banker were defined by the adage of three-six-three: borrow money from depositors at three per cent, lend it out at six per cent and hit the golf course by 3 p.m.

“It’s less about ethics than about what we want our banks to do and how to do it,” Kirchmaier says. “As a global society we have to ask ourselves: do we want to have fancy-schmancy banks who do all sorts of cool things that nobody understands? Or do we want to accept that there are limitations to what is possible?”

But an overhaul is easier said than done in an industry that has profited so handsomely from the growing size and complexity of its operations. “The short answer is probably no, we can’t trust the banks to regulate themselves,” says Grossman. “People and institutions react to incentives and there’s a lot of money to be made in financial sectors as long as that incentive is there.”