Econowatch: October 2011

A monthly scorecard on the state of the economy in North America and beyond

Mike Blake/Reuters

Share

The TSX is down 20 per cent from its April high. It’s official, the bear market is back. The financial news is so bleak that even viral videos, which normally feature cute animals and footballs hitting groins, seem to have lost their sense of humour. Last week, one of the most talked-about Web videos was of a stock trader telling a BBC interviewer how the economic crisis is a cancer. “If you just wait and wait hoping it is going to go away, just like a cancer it is going to grow and it will be too late,” said Alessio Rastani, who argued that “the stock market is finished” and that people should hedge against an inevitable crash, like hedge funds are now doing.

Bloggers and business publications were quick to question Rastani’s bona fides. He’s self-employed, has modest holdings and is, in short, just an average guy. Which maybe explains why his message touched a nerve among average investors trying to make sense of the market chaos as their savings evaporate.

More importantly, it speaks to the extent that the economic crisis is one of confidence. Consumer confidence surveys show optimism has gone AWOL, even despite recent data showing there are silver linings. In the past months, companies have continued to go about their business—factories are humming in Canada and the service sector is growing. In the U.S., economists are predicting GDP will grow in the third quarter. Troubles still loom large. Employment is stalled and the eurozone is teetering. But tune out the markets for a moment, watch the likes of Rastani with all the seriousness you would a kitten slipping off a windowsill, and things aren’t so bad. Or at least, they could still be a lot worse.

By The Numbers

60 years | The prison sentence given to U.S. hedge fund manager Adley Abdulwahab, who ran a $100-million fraud scheme.

$199 | The price of Amazon’s much-anticipated new tablet computer, the Kindle Fire.

$43.5 million | Supercar-maker Spyker’s sale price. It was bought by an American private equity firm.

$563 million | The final renovation bill for B.C. Place Stadium, which now has a new retractable roof.

$800 million | Multimedia blogging site Tumblr’s value, after raising $85 million in funding.

$5 billion | What climate change will cost Canada each year by 2020, according to a new report.

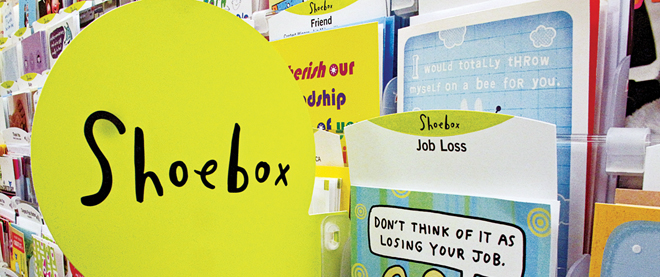

So you lost your job

Hallmark has discovered a new market for its cards: the roughly eight million Americans who have lost a job since 2008. Some of the cards strike a sympathetic tone, while others are more humorous, like the one featuring a cat that asks: “Is there anywhere I could hack up a hairball, like say, on a former employer’s head?”

The Swiss watchmaker TAG Heuer plans to open a new sales website in the U.S. next year. It also plans to open 22 boutiques and as many as 300 outlets in cities and in airports (for those really last-minute luxury gifts) over the next five years.

An art installation called Power Toilet offers customers at a New York diner a view of an exact replica of the executive washroom at JPMorgan Chase’s headquarters. “It’s about making private spaces public. And it’s about the excesses of Wall Street,” an organizer told the New York Times, describing the $10,000 project.

The decline of the PC continues. IBM passed Microsoft to become the second-largest technology company, after Apple. The market value of IBM, which now focuses on corporate software, hit US$214 billion, compared to Microsoft’s US$213 billion.