No, Alberta’s oil patch doesn’t need a bailout

Alberta’s energy sector has yet to suffer anything like Ontario’s manufacturing job losses, so calls for an auto sector-style bailout for the oil patch are premature

Petro-Canada’s Edmonton Refinery and Distribution Centre glows at dusk in Edmonton. (Dan Riedlhuber/Reuters)

Share

This post originally appeared at Canadian Business.

There is a meme floating around Canadian policy circles that if the job losses currently occurring in the oil and gas industry were happening anywhere else in Canada, we would see a bailout. Like many memes, it is difficult to precisely identify its origins. The most likely origin appears to be comments made by Saskatchewan Premier Brad Wall in late November:

“The energy economy of Western Canada has shed thousands and thousands of jobs, and there’s no prospect for immediate recovery… Were this any other sector in Canada’s economy, there would be a race to bail out the industry from governments and, frankly, much more coverage of the issue, but there isn’t.”

Industry bailouts are exceptionally rare in Canada, with the most notable being the auto bailout of late 2008 to early 2009, where two of Ontario’s then six automotive assemblers received assistance from the federal and provincial government. Given the rarity of industry bailouts, I believe it is safe to assume Wall is alluding to the auto bailout.

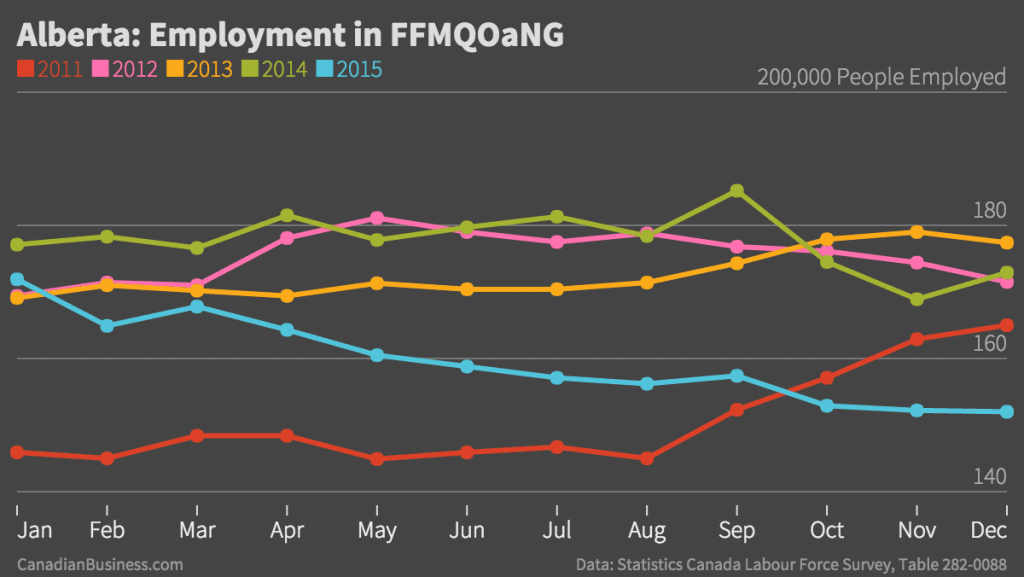

If the decline in automotive (and manufacturing more broadly) is the standard for an industry bailout, does the recent employment decline in the oil and gas sector meet that standard? One test is to compare the downturn in employment in Alberta’s oil and gas sector and compare it to the downturn in Ontario’s manufacturing sector, prior to the bailout. Canada’s Labour Force Survey contains monthly job data by industry broken down by province. The category “forestry, fishing, mining, quarrying, oil and gas” (FFMQOaNG) shows a substantial decline in employment in 2015:

Unfortunately, we cannot break the data finer than this, so the inclusion of forestry and fishing creates some noise in the data, but it should be relatively minor given the size of the oil and gas industry relative to the size of forestry and fishing.

Roughly four per cent of Alberta’s 4.2 million people are directly employed in the FFMQOaNG sector. The average employment level was 18,000 persons lower in 2015 than it was in 2014, representing 10 per cent of the sector and 0.4 per cent of Alberta’s population. Even with the three per cent employment increase in the sector the year before, no one would deny that this has greatly affected the province’s economy and caused indirect job losses in other sectors as well.

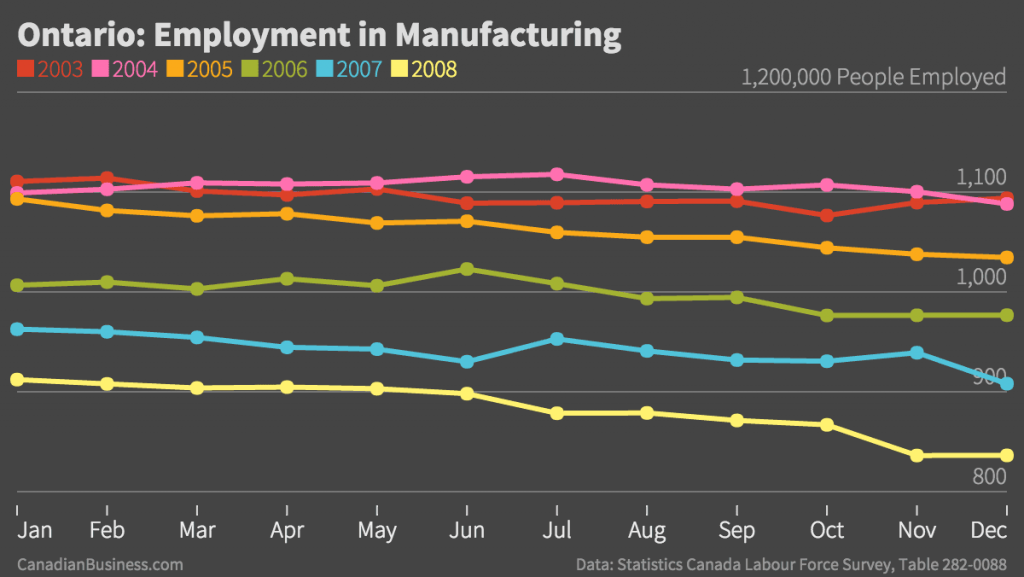

To put this job loss into perspective, here are the employment levels in manufacturing (of all types) in Ontario between 2003 to 2008, from the same data series:

In 2004, which saw a slight increase in manufacturing employment from the year before, almost nine per cent of Ontario’s 12.3 million people were directly employed in this sector, a concentration over twice that of “forestry, fishing, mining, quarrying, oil and gas” workers in Alberta. Year-over-year, Ontario’s manufacturing industry shed 42,700 jobs in 2005, 63,900 in 2006 and 57,500 in 2007 and continued losing jobs into the 2008 Great Financial Crisis. This represents sectoral employment reductions of four to six per cent per year, every year. For a single year this is lower than the 10 per cent reduction Alberta experienced in 2015. However, from the start of 2004 to the end of 2008, Ontario shed almost 20 per cent of manufacturing jobs, whereas Alberta’s job decline has been over a single calendar year.

| Ontario Manufacturing | Alberta (FFMQOaNG) | ||

|---|---|---|---|

| Year | Jobs Gained/Lost as % of Sector | Year | Jobs Gained/Lost as % of Sector |

| 2004 | +0.92% | 2011 | +7.82% |

| 2005 | -3.86% | 2012 | +16.46% |

| 2006 | -6.01% | 2013 | -1.58% |

| 2007 | -5.75% | 2014 | +2.92% |

| 2008 | -6.20% | 2015 | -10.14% |

| 2004-2008 | -19.38% | 2011-2015 | +14.29% |

The numbers look more bleak for Ontario when examining jobs lost or gained as a percentage of the population, since Ontario has a higher proportion of manufacturing workers than Alberta does in FFMQOaNG.

| Ontario Manufacturing | Alberta (FFMQOaNG) | ||

|---|---|---|---|

| Year | Jobs Gained/Lost as % of Population | Year | Jobs Gained/Lost as % of Population |

| 2004 | +0.08% | 2011 | +0.29% |

| 2005 | -0.34% | 2012 | +0.64% |

| 2006 | -0.50% | 2013 | -0.07% |

| 2007 | -0.45% | 2014 | +0.12% |

| 2008 | -0.45% | 2015 | -0.43% |

| 2004-2008 | -1.65% | 2011-2015 | +0.48% |

As a percentage of the population, the manufacturing losses were higher in Ontario in each of 2006, 2007 and 2008 than they were in Alberta in 2015. Alberta has only experienced one year of loss, whereas Ontario experienced 3½ consecutive years of such losses, only to be rewarded with a global financial crisis, after which time two of six automotive assemblers received a bailout package.

These manufacturing employment declines arguably understate the collapse of manufacturing employment, as the job losses were disproportionately felt in southwestern Ontario. The four biggest manufacturing centres in the southwest are the CMAs of Hamilton, London, Windsor and Kitchener-Waterloo. In the mid-2000s, just under two million people lived in this area (which I will dub ‘Manufactura’), a population roughly half the size of Alberta. In 2004, 228,500 people were employed in manufacturing, representing 11.6 per cent of the total population. Contrast this to the roughly 180,000 people who worked in FFMQOaNG in Alberta, a province with twice the population of manufacturers.

Manufacturers’ job losses were relatively modest in 2005, shedding 8,200 manufacturing jobs over the year. Things escalated quickly, however, as the region lost over 17,000 manufacturing jobs in 2006 and more than 15,000 in 2007, again in a population half that of Alberta. This was well before the Great Financial Crisis of 2008-2009, where another 28,300 manufacturing jobs were lost over those two years. The percentage of jobs lost in the sector in 2006 and 2007 are in line with Alberta in 2015 and are twice as high when measured as a percentage of the population.

| Year | Jobs Gained/ Lost (% of Sector) | Jobs Gained/Lost (% of Population) |

|---|---|---|

| 2005 | -3.72% | -0.41% |

| 2006 | -8.58% | -0.87% |

| 2007 | -8.10% | -0.76% |

| 2008 | -10.09% | – 0.85% |

The oil and job losses in Alberta in 2015 look quite similar to, and are arguably smaller than, those in manufacturing in London, Hamilton, Windsor and Kitchener-Waterloo in each of the years of 2006 and 2007. Despite this, there was no “race to bail out the industry from governments” in 2005 or 2006 or 2007. The two employment declines have similar sources, namely substantial movement in the world price for a barrel of crude. Ontario is hit twice by rising commodity prices, from paying more for oil to being less competitive due to a rising petro-dollar. Alberta, on the other hand, sees the impact of lower commodity prices cushioned by a lower dollar.

Despite Wall’s claims to the contrary, there was no race to bailout southwestern Ontario when oil prices rose between 2004 and 2007. Why should there be a race to bail out Alberta when they fall?

The context of the auto bailout was very different than the recent slide in commodity prices, as the bailout followed four years of significant job losses and a financial crisis which seized up global credit markets. Neither of those things have yet to happen in Alberta, but if they do talk of a bailout would be quite reasonable.

A single year of job losses? Hamilton and Windsor wish they were that lucky. When thousands of oil sector jobs are lost in Western Canada, it’s called a collapse. When thousands of manufacturing jobs are lost in southwestern Ontario, it’s called Tuesday.