Canadians and debt: The struggle is getting worse

One in five is borrowing to pay for daily expenses

Chart: Erica Alini. Photohraphy: Getty Images

Share

A new study on household finances shows that Canadians are struggling even more with their mortgage and debt than they were two years ago.

The Canadian Association of Chartered Accountants annual survey of household finances found that nearly half of Canadians say they couldn’t manage their mortgage and debt payments if interest rates rose. Nearly 30 per cent of those said they couldn’t even handle an interest rate increase of less than two percentage points.

Those are scary numbers, considering that the Bank of Canada hinted today that it is leaning towards raising interest rates, even as other central banks are moving in the opposite direction in response to a slowing global economy.

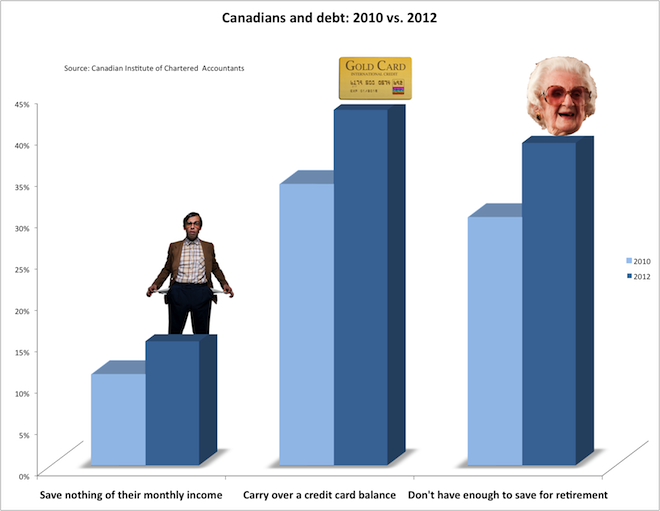

Here’s few more jaw-dropping highlights from the survey:

* We’re saving less than we did just two years ago. In 2010, 51 per cent of Canadians saved less than 10 per cent of their income, while 14 per cent saved more than 20 per cent. By 2012, the proportion of Canadians who saved more than 20 per cent of their income had dropped to 11 per cent and the proportion of those who saved less than 10 per cent had risen to 59 per cent.

* Nearly half of those aged 55 or older say they haven’t saved enough for retirement, while 40 per cent of Canadians say they don’t expect to have paid off their mortgage by the time they turn 65 and plan to keep working past retirement age to make ends meet.

* Forty-three per cent of Canadians carry a credit card balance from one month to the next, up from 34 per cent in 2010.

* Almost a fifth of Canadians borrow to pay their daily living expenses and nearly half of them still owe money on those loans.

The one bit of good news was that nearly 40 per cent of Canadians felt they were better off financially this year than last year, with 59 per cent of those saying they had paid down some of their debt and 58 per cent saying they were earning more money.

Click here to see what happens to a $300,000 mortgage if rates rise by 1.5 per cent.