RBC

Facebook’s breakup with a Canadian bank

Documents from a British parliamentary investigation show questions about access to user data caused RBC to end online transactions via Facebook

Why banks are so slow to lower lending rates, but so quick to hike them

Econo-metrics: With the Bank of Canada raising interest rates, the big banks have been quick to follow suit. That never seems to happen when rates are falling.

Can RBC help stop Canada’s brain drain in deep learning?

Despite RBC nabbing a big name, it’s hard to be optimistic that the stars of a hot, made-in-Canada tech field won’t decamp to the U.S. anyway

The race to be Canada’s first $1-trillion bank

It reinforces just how massive Canada’s banks are relative to the economy

The keys to BlackBerry’s revival?

Command keys are coming back to the BlackBerry keyboard. Welcome to 2008.

The danger of high-frequency traders

Why critics fear HFTs are undermining markets, one penny at a time

Canadian investors flock to high-risk debt

The appetite for risky debt is growing in Canada as investors search farther afield for ways to boost their portfolios, according to Royal Bank of Canada, the country’s largest corporate debt underwriter.

A schooling in America’s finances

How complex financing deals between banks and U.S. cities went bad

Shareholders rejoice: Canada’s five biggest banks delivered $7.8 billion in profits

There are headwinds ahead, say experts, but fatty dividends for now

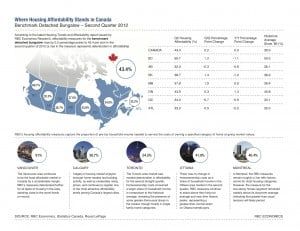

RBC: Homeownership costs are now 91 per cent of Vancouverites’ income

But affordability is deteriorating across Canada

U.S. regulators to sue Royal Bank of Canada over “sham” futures trades

Toronto-based Royal Bank of Canada is being sued by American regulators for allegedly engaging in illegal futures trades, Bloomberg reports. The U.S. Commodity Futures Trading Commission is “seeking monetary penalties and an injunction against further violations.”

According to Bloomberg, RBC “is being sued by U.S. regulators over claims that [it] engaged in a series of illegal futures trades worth hundreds of millions of dollars to garner tax benefits tied to equities.” The article continues:

Don’t bank on it

The toughest critics of the TSX’s merger plans are also Bay Street’s biggest players