The oil price crash and the oil sands

Oil sands production will continue to increase in the near term, likely through 2020 if not beyond, unless prices decrease materially relative to today

Share

In preparation for testimony before the House of Commons finance committee in Ottawa on March 10, I pulled together some thoughts on three aspects of the impact of the oil-price crash on oil sands projects and policies, and I thought I’d share them with you here over this and the next couple of posts.

In my short statement, I’m going to look to provide committee members with context for three questions.

First, I want to look at how the changes not just in oil prices, but also changes in diluent costs, discounts for oil sands crude relative to light crude and, in particular, the fall of the Canadian dollar have changed the outlook for new oil sands projects, for those under construction, and for those currently operating.

Next, I want to address the potential impact of new GHG policies on oil sands projects — in short, I want to show that the Prime Minister’s contention that it would be crazy to impose new GHG regulations on the oil sands sector was incorrect.

Finally, I want to look briefly at the question of refining and upgrading, and ask whether changes in crude and products pricing have changed the relative value of new refining and upgrading assets in Canada or elsewhere. That’s a lot for a five-minute statement, so I’d better get started. Here, in part one of three, are my notes on oil sands project viability in this new, low-price environment:

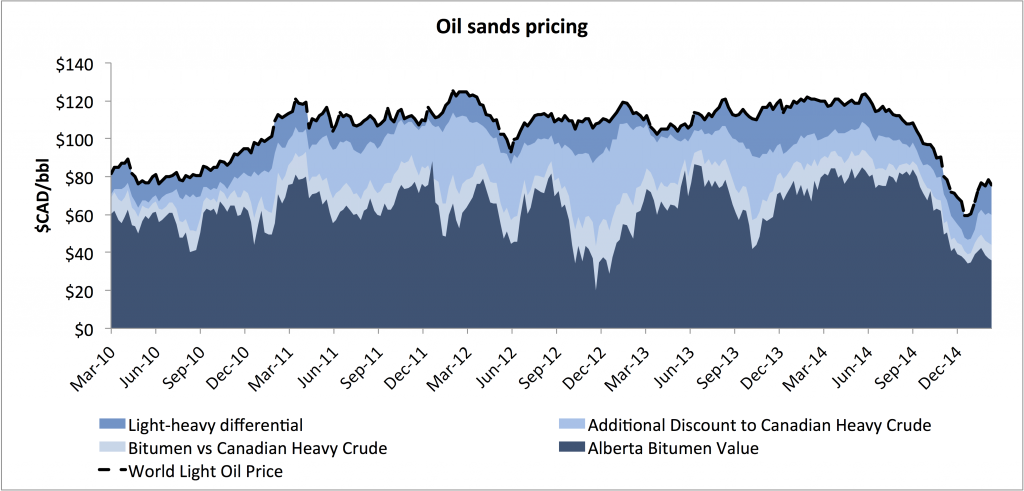

Since July, oil prices have fallen significantly, and with them the revenue earned or expected from oil sands projects, present and future. From July to December, the story was one of oil sands bucking the trend, to a point—while global oil prices dropped, discounts applied to Canadian heavy oil dropped as did the costs of the diluent used to ship oil sands products via pipeline, and so the value of oil sands bitumen declined by less than world oil prices. This trend has reversed in recent weeks, with larger discounts applied to global and Canadian heavy crude leading to bitumen prices remaining low while world oil prices have gained some of the lost ground. The future viability of oil sands projects depends not just on your view of world oil prices—it depends just as much on how these factors evolve, in particular discounts to Canadian heavy products and the Canadian dollar.

With so much talk about pipelines, Canadians are likely more familiar than they have ever been with oil sands growth forecasts. If you look at most of the more prevalent growth forecasts, from industry groups, banks, or investment houses, you’ll see a ready division into three categories—operating projects, projects currently under construction, and projects either permitted or planned, but for which no substantial construction has been undertaken. If you look at CAPP’s most recent forecast, from June 2014, you can see the importance of this distinction. Current production of oil sands bitumen is just over two million barrels per day, while adding in sites currently under construction alone will raise that production to almost three million barrels per day by 2018-19. CAPP’s growth projection, made under the higher oil prices of early 2014, had accounted for an additional two million barrels per day of new production, with total bitumen production reaching five million barrels per day by 2035. In order to understand the impact of the oil price crash on oil sands, you need to look at the implications for each of these categories.

First, while existing operations have seen drastic reductions to their cash flows, few if any are in danger of shutting-in production at current prices. The most expensive projects, on an operating-cost basis, are the integrated mining operations (a few bottom-tier thermal sites may be higher, but on average the mining sites have the highest costs) such as Suncor, Syncrude, Shell and CNRL. If we look at CNRL’s operations at Horizon, we can get a good sense of the value of a pure play in this space—through the third quarter of 2014, before the oil price crash really took hold, the operating costs for synthetic crude oil production at Horizon were $38.31 per barrel. Today, synthetic crude oil is trading, in Canadian dollar terms, at well over $60 per barrel—a healthy operating profit margin. Suncor provides a good, diversified example of the sector—Suncor markets oil sands products from a variety of operations, both mining and in situ operations, and sells both diluted bitumen and synthetic products including diesel fuel. In the last quarter of 2014, its products traded at an average discount of $13.57 to WTI—an average revenue of $69.51, down only marginally from a year before. With cash operating costs of $34.45 per barrel for its oil sands operations, Suncor has retained a healthy cash margin through the downturn. So, while existing projects may not return expected cash flow to shareholders or parent companies, they are unlikely to shut down under current conditions.

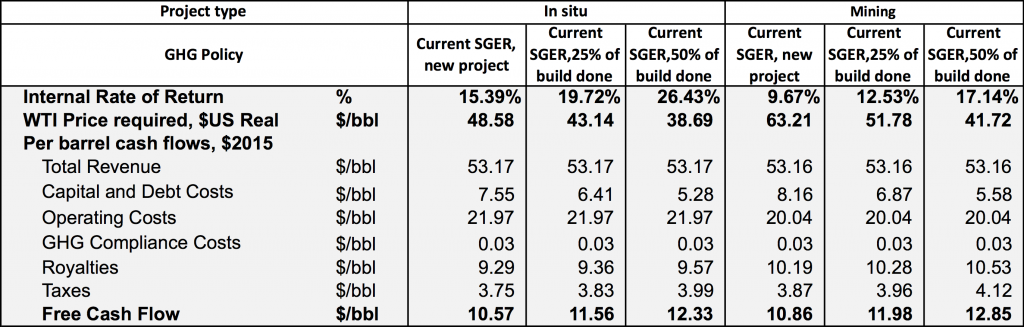

New projects are a bit of a different story but, as always with economists, there are multiple factors to consider. The first, important distinction is the type of potential new project, while the second is the degree to which construction has already begun. Consider the table below, which summarizes cash flows and returns on investment for various oil sands projects.

The key thing you should notice is that the returns on the smaller in situ projects are higher—this is because they are cheaper to build and operate per barrel of future production. If you’re talking about a new project with no significant investment already deployed, building a new mine if you expect today’s prices to hold in the long term is a tough call—a 50year oil sands project is a lot of risk for less than a 10 per cent rate of return—but even there, you can see the impact of the lower Canadian dollar and the hedge provided by a royalty regime which lowers rates when prices are low. While we used to think of new mines as projects that required WTI prices near $100 per barrel to be viable, we can see 10 per cent rates of return on investment at WTI prices below $US65 per barrel for a new build. For in situ projects, today’s oil prices yield healthy rates of return—part of why you should, perhaps, not expect quite as much of a pull-back in new oil sands investment once the firms involved have a chance to assess the situation.

The case for sustained development gets even stronger when you look at investments with significant capital already deployed. For a mine project like Suncor’s Fort Hills, with about 25 per cent of construction already completed, the forward-looking decision would imply a return on the balance of capital invested of 12.5 per cent—now, the project returns overall might be lower than that, but when you’re considering a decision to abandon a partially built mine, you’re not likely to get much of a return on they money you’ve already invested in it if you don’t continue building. For in situ projects with steel in the ground, the likelihood that companies are going to forgo the opportunity to complete these projects and bring them online seems even lower than for the mines.

So, what does this all mean? Oil sands production will continue to increase in the near term, likely through 2020 if not beyond, unless prices decrease materially relative to today. If they remain as low as they are, there’s certain to be a downward revision in the long-term growth forecasts for oil sands, but don’t expect production to decline in the near term. At today’s prices, industry forecasts of three million barrels per day by 2020 are likely to underestimate production by a bit, but the real kicker will be on the value of that production to all concerned—governments, via taxes and royalties, and shareholders will all suffer much lower returns from this development than they would have expected less than a year ago if prices stay where they are today.