What would energy look like under a Wildrose government?

Where Wildrose leader Brian Jean stands on the pace of oil sands development, carbon pricing, and what Alberta should do with its oil wealth

Share

The Alberta election is creating some strange and unexpected storylines. The potential for an NDP government has certainly garnered the lion’s share of attention inside and outside the province, but another storyline deserves attention as well. The Wildrose, written off as good-as-dead by many after their leader, Danielle Smith, along with 10 MLAs, crossed the floor to the governing PC party in the fall, has staged a stunning comeback under new leader Brian Jean. While their polling numbers have fallen off a bit, the party that saw its initial rise stoked by the El Stelmach government’s royalty review is surprising many and may yet come to hold the balance of power after the votes are counted on Tuesday evening.

As I’ve done with the NDP and the PC parties, I sent four questions on energy policies to the Wildrose and their campaign responded on Wednesday morning. You can read their answers here.

I was most curious to hear about Wildrose Leader Brian Jean’s position on oil sands development. As a native of Fort McMurray and longtime federal MP for that community, it had been a little surprising when he stated, in a pre-election interview with the Financial Post, that, “It’s the wild west up in Fort McMurray … too many licences have been handed out to developers competing with each other on all levels, driving up costs, requiring the import of labour from across Alberta and around the world, while forcing workers to spend hours a day commuting to oilsands plants before 12-hour shifts.” He’s certainly correct about cost inflation. While things have begun to mitigate a bit in the downturn, oil sands costs had increased more than twofold in a decade, and that’s made our industry far more vulnerable to the global price drop we’re seeing now and also ate into our royalty and tax take from the resource. The answer I got surprised me. “While the pace of development was and should always be driven by market forces, it is incumbent upon the province to ensure that the infrastructure on the impacted community keeps pace with enormous demands on health care, roads, housing and the other amenities of life all other Albertans expect and demand.” So, the problem wasn’t with the uncontrolled pace of development, but with the province not doing enough to keep up. That’s nice, in theory, but it’s hard to see how a province racing to provide health care, roads, and other services as fast as industry can announce new projects doesn’t exacerbate cost inflation. It’s basic resource economics that, in an open access resource industry, rents will be dissipated to other scarce factors of production. In English, that means that if you allow uncontrolled access, costs are going to keep going up — wages, housing, pressures on infrastructure, traffic — until the market for these things constrains further development growth. If you’re going to leave things to the market, the market will keep piling in until they can no longer earn a rate of return, and a government trying to keep costs down will simply be trying to put out a fire with gasoline.

In his interview with the Financial Post, Jean went on to say that, “the pace of the oil sands doesn’t need to be sporadic … it needs to be well-planned. We have to have a long-term vision.” I absolutely agree—thing is, we don’t have a sense of what that plan would be as of yet, from the answers provided here or from the Wildrose platform. Actions like releasing more land for housing or expanding infrastructure would help for a while, but eventually the market would do what it does, which is to chase returns, and the pressures would return and start the would begin anew. The Alberta government is the single largest player in the market for oil sands. Leaving the pace of development to the market is not an option—it’s what got us into this mess in the first place.

I did really like the next part of the answer I received—that a long-term oil sands industry has to rely on a long-term, stable community in Fort McMurray. McMurray has changed a lot in my time in Alberta, but I think many still see it as an single-industry town, which it is, but more importantly one which could become a ghost town overnight. McMurray today likely has as many parallels with southwestern Ontario as with the oil boom towns of years gone by. The mines and upgraders located north of town provide stable, long term employment and though the oil sands will still be subject to the global market and vulnerable to increasing costs of producing it here, I think we need people to believe in McMurray as more than a flash in the pan. That’s one thing Jean clearly shares with me, and a view with which more Albertans need to become comfortable.

In writing about the NDP platform, I stated that all the parties agree (and that I disagree with them all) on the need for more refining to take place in the province. The Wildrose platform looks to “ensure the Alberta advantage extends to value-added industries so that investment in these valuable jobs is not artificially constrained by uncompetitive regulations or tax rates.” It’s true that our refining industry has not enjoyed the same generous tax treatment as has been offered for refinery retrofits in the U.S. under the Energy Policy Act revisions of 2005 and 2011, which were likely part of the perfect storm that led to many upgrader projects coming off the books in Edmonton, so I thought that might be where the Wildrose was leaning in their platform. While the answer wasn’t specific, it did open this possibility: “There should be no barriers and possibly broad based tax-driven incentives to add value to Alberta’s primary hydrocarbon resources prior to sale.” Wildrose also emphasized a move beyond simply refining or upgrading bitumen, to focus on “other opportunities in petrochemical processing using terribly undervalued products like propane and butane as feedstock.” As with the NDP, it seems reasonable to ask why we would devote tax incentives to making refined products for others and furthermore, if we’re concerned about cost inflation and development pressures in the oil sands industry, why we’d want to throw fuel on the fire building upgraders and petrochemical plants.

While I didn’t ask the question directly (in retrospect, I wish I had), the Wildrose campaign made it clear that there is no either/or when it comes to refineries or pipelines. They are correct, although they did omit an important interaction. Refined or upgraded product doesn’t require diluent, and so the total volume shipped out of Western Canada would be lower if we had more domestic processing. So when the Wildrose campaign spokesperson says that “adding value to raw oil and gas through primary processing cannot be regarded as a replacement for pipelines,” that’s only partially the case. They’re correct that refineries generally see processing gains (Cenovus sees about a four per cent processing gain on bitumen) and so produce more refined product than the volume of bitumen they take in, but the lack of diluent movements could reduce total export pipeline capacity requirements by as much as 50 per cent, and would also reduce the need to import diluents freeing up some capacity in the existing pipeline network. So while there may not be an either/or, there is an important relationship between how much we refine versus how much we ship out as diluted bitumen and how much new pipeline capacity is required for export.

In the last election, among other things, a response to a question on climate change was part of what enabled the fear campaign against a Wildrose government, so I was anxious to hear what they have to say on the topic this time around. Climate change underpins so many of the objections to oil sands pipelines, it’s imperative that a party committed to securing market access have a policy which reconciles oil sands growth with global climate concerns. The Wildrose platform states that they would “ensure Alberta’s standards for CO2 emissions are in line with national and international standards.” This is pretty vague: which international standards is the obvious question. Their answer didn’t add a lot, and seemed to fall back on explanations for why they oil sands aren’t compatible with climate change policy. “Alberta is also subject to global pricing,” we don’t have access to tidewater, and “operating costs in Alberta are also higher than many other regions due to strict regulations on worker protection, environmental protection, high wages, and the seasonality of activity caused by spring breakup.” I’m not sure that has as much resonance outside of Alberta, or with those who are seeking to stop Alberta’s treasured pipelines, as would a credible policy.

The Wildrose opens the door to more stringent action, if you’re prepared to give the benefit of the doubt. “The Wildrose view on GHG emissions and levies will be congruent with that of other producing jurisdictions. However, for Alberta to introduce GHG levies on its oil and gas production while competitors do not will lead to a situation that make Alberta even less competitive, something the Wildrose Party is not prepared to do.” This is very similar to the position taken by Prime Minister Harper’s government in Ottawa — that we will act in conjunction with the U.S., but not alone. This makes sense for conventional oil, where the investments are mobile, since the resource exists on both sides of the Canada-U.S. and Alberta-Saskatchewan borders, but not as much for oil sands. People are not blockading pipelines because of concerns about light oil in the Duvernay — they’re concerned about the oil sands. The Conservative approach from Ottawa hasn’t done much to improve the public perception of oil sands or the prospects for pipelines, so I am not sure we need an echo of it here in Alberta. The Wildrose is right to point out that we have a lot to be proud of with respect to our regulatory practices here in Alberta. For example, it’s likely the new U.S. regulations on flaring will impose standards similar to those Alberta has had in place for decades. I’d like to see a government more prepared to put pressure on other jurisdictions to match some of Alberta’s better practices, but we have to make sure we’re not just going to take our ball and go home when they try to do the same to us.

Finally, since all parties also agree that we should save more from our resources, I asked all the parties about what they’d do with the savings and how the use of these funds would be restricted. The Wildrose points out, correctly, that “these resources belong to all Albertans,” but it’s not as clear that “spending virtually all resource revenues and saving none for the future is an indictment,” nor is it clear that “racking up debt for future generations compounds the injustice.” If we believe that Alberta’s oil sands industry is going to grow to more than double its current size, surely that must imply an expectation of higher revenues in the future than in the present. Perhaps these revenues may still be relatively short-lived, but as my Maclean’s colleague Colby Cosh has pointed out a number of times, if you want to make the case for savings, you’ve got to make the case that it’s reasonable to expect that without these savings, future Albertans will be worse off than we are today. If we expect that they’ll be much better off, maybe they would not feel so bad about having a little bit of our debt to pay off?

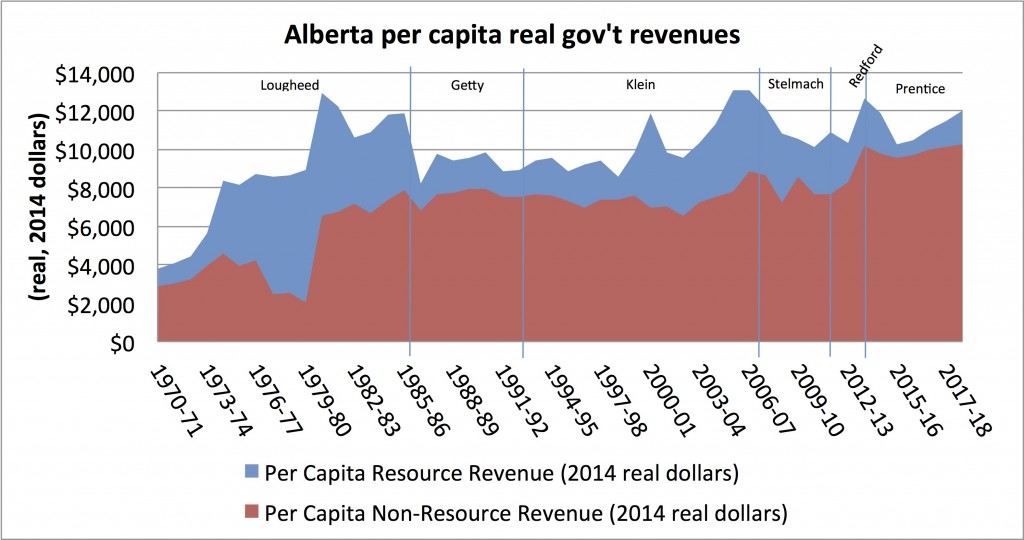

The Wildrose links savings and spending, stating that, “if we were spending $5b less, we would have no revenue problem, even with oil at $50 per barrel.” While its true that less government spending would require less government revenue, the image below gives you a sense of the challenge that low oil, high inflation, and increased population inflow would present. I agree with Wildrose that a core issue for the next government will be “managing our spending so that, in a price climate such as the current one, we can still get by with nothing more than a small withdrawal from the contingency account.” However, if you look at the inflation-adjusted per capita revenue forecast in Budget 2015 shown below, it’s lower than we’d seen in a decade. To deliver real improvements in services with fewer real dollars to spend will be challening. Given the pressures which exist to both improve services and infrastructure (see the answer to the first question, for example) as well as save resource revenues, the temptation will be there for any government to talk about saving through investments in Alberta. I’m very pleased to see that “Wildrose does not support politicians using the Fund for ‘diversification’ initiatives. The Fund’s goal should be to grow to such a size that its income can actually replace our oil and gas revenues once they begin to permanently taper off.” The challenge will be to decide what is eligible for investment. Here, I like Norway’s rule (yes, I’m Norwailing) that the funds should be invested outside Norway. This provides a modest currency hedge, but more importantly a shield against what Wildrose calls “politicized attempts to divert the principal and interest for present day use.”

Overall, the Wildrose platform puts forward a plan to carry on with some of the solutions that have caused many of our current problems, and also some potential solutions to other issues we face. On pace of development, we have to view the government (on our behalf) as a player in the market — the key player — and to ignore that only costs us all. Just as a condo developer does not ignore the impact of new developments on the value of other properties, we can’t ignore the impact of new projects and rapid development on our existing oil sands. On refining, I think the Wildrose has the right ideas, but that the push for value-added is so strong that they feel the need to nod to it in their platform. I’d worry less about government refinery boondoggles under a Wildrose government. On GHGs, I think the Wildrose needs to do a much better job of telling us how our economy is prepared for a carbon-constrained world, not how we can’t place carbon constraints on our economy. Finally, on savings, I think the WRP is well-positioned to avoid the propensity for governments to avoid seeing spending as savings. It’s a lot to expect an opposition party that has elected a new leader within days of the election call to have a well-fleshed-out position on every issue, so I think we have to give some benefit of the doubt here too. If we do see a Wildrose government or a Wildrose opposition holding the balance of power, it seems that they would govern or vote with a bit of Klein and a bit of Prime Minister Harper. If you like that combination, you’ve likely already decided to vote Wildrose.